Spouse low credit score mortgage

As we said most lenders including Rocket Mortgage require a minimum credit score of 620 for a conventional mortgage. It considers factors like education.

How To Get A Bad Credit Home Loan Lendingtree

However if you are.

. If your parents or spouse have a good credit score then you can raise a personal loan by adding your name to the personal loan application as a joint loan holder. If you are salaried and have a bank account you can approach your banker for a credit card. Upstart is one of the few companies that look at factors beyond your credit score when determining eligibility.

This commonly includes mortgages auto loans and lines of credit. Using your Parents or Spouses Credit Score. Flagstar Bank this lender has cheaper than industry-average mortgage rates but you might want to consider improving your credit or getting credit repair to meet a minimum credit score of 580 Movement Mortgage offers USDA regardless of state.

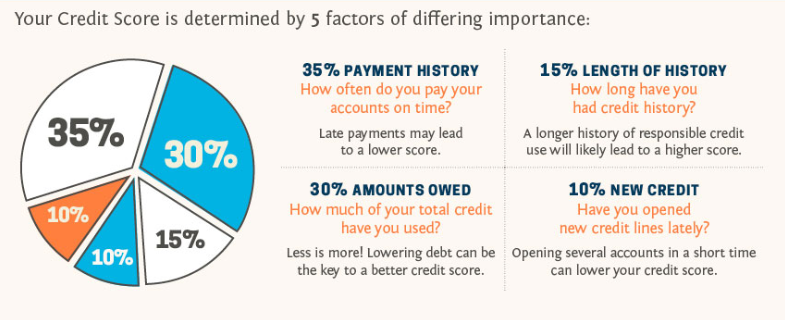

Find Out Whos Responsible. If you have a home equity loan or variable-rate mortgage pay attention to the Fed. Credit bureaus use the data in the report to compile your credit score.

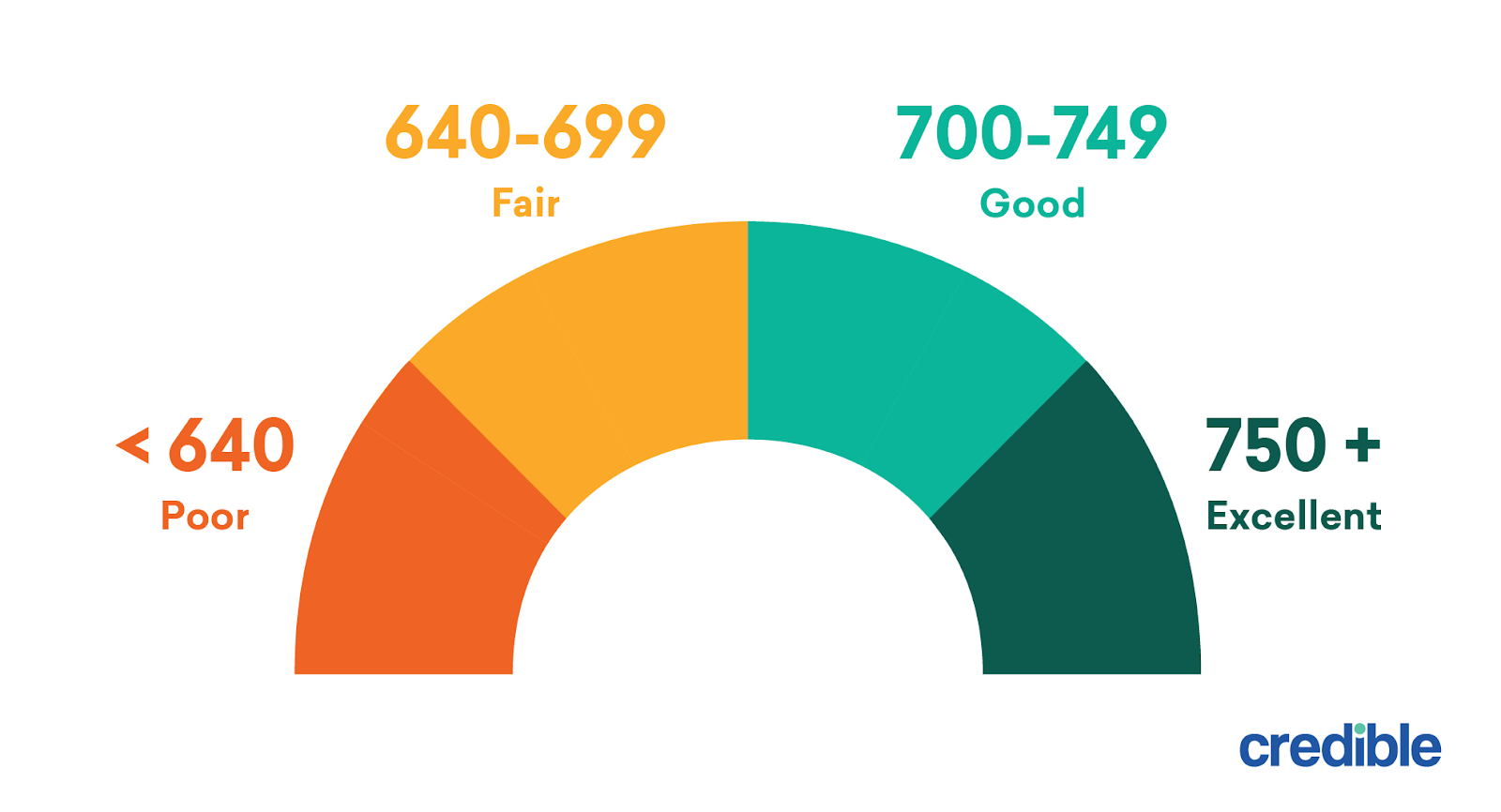

It also offers fairly low interest rates. In addition your income may not exceed 115 percent of the median income in your area and you have a steady income and enough savingsassets to make mortgage payments for at least 12 months. Finally your credit score is around 640 or better.

Before proceeding any further make sure cosigners and joint borrowers are aware of your loved ones death. 2 min read Sep 15 2022 Latest mortgage news. Home mortgage credit card or other types of credit.

Joint responsibility doesnt apply to additional cardholders or authorized users. Rememberresponsibility for mortgages credit cards student loans and other joint debts automatically pass to the surviving account holder. Your spouse is also responsible for paying the balance on any joint credit card accounts even if you.

Get a Credit Card. Minimum conventional loan credit score needed. FHA loans are insured by the Federal Housing Administration making them less risky for lenders and because of this easier to qualify for than conventional.

Rates surge further past 6 a 14-year high.

How To Get A Home Loan With Bad Credit In New York Propertynest

Buying A House Without Your Spouse Community Property Edition Quicken Loans

How Does Getting Married Affect Your Credit Score Lexington Law

Your Fico Score Vantage Mortgage Brokers

Va Mortgages And Credit When Your Spouse Has Bad Credit

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

Pros And Cons Of Applying For A Mortgage Without Your Spouse

How Do Co Borrowers Credit Scores Affect A Home Purchase

Fha Credit Requirements For 2022 Fha Lenders

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2022 Badcredit Org

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

Getting A Mortgage When Your Spouse Has Bad Credit

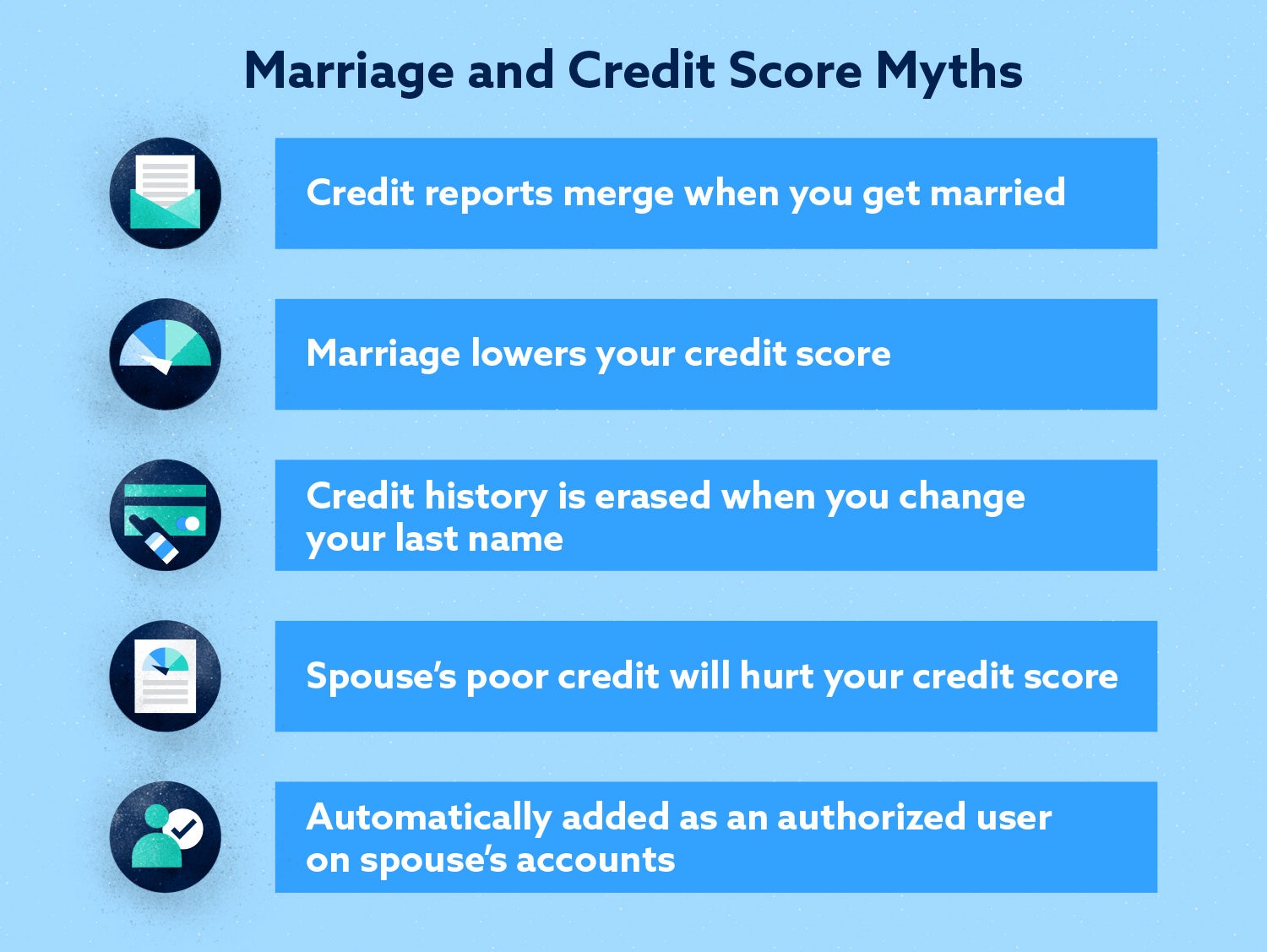

Will The Credit Score Of Your Spouse Affect You After Marriage

640 Credit Score Mortgage Rate What Kind Of Rates Can You Get Credible

How Does Getting Married Affect Your Credit Score Lexington Law

Getting A Mortgage When Your Spouse Has Bad Credit